Adani Airports Secures Strategic Financing to Transform Mumbai’s Aviation Landscape

Recent picture of the Mumbai international Airport (Chhatrapati Shivaji Maharaj International Airport) aerial view with its terminals runways and in the background can be seen the Mumbai skyline.

This is an historic appurtenance that denotes the further stratospheric inclination of the Indian airborne infrastructure as Adani Airports recently has been able to attract huge financing facilities to its Mumbai International Airport, which generated another swimming boost in the soaring portfolio of the Adani conglomerates in its venturesome propagation at the Indian airborne regulatory apparatus. The most recent transaction at hundreds of millions of dollars is not only a testimony of numbers in a balance sheet but more a summation of the confidence that international investors have of aviation future in India and in the capabilities of Adani in striking world-class airport experiences.

The Apollo Partnership: A Winning Win-Win

A dual image of Apollo Global Management headquarters and/or logo and the Adani Group logo shows that these two industry giants have formed a partnership.

The latest of event this financial escapade was written yesterday, when Apollo Global Management, using an investment grade rated financing, closed off a $750 million financing on behalf of Mumbai International Airport Ltd. This is not the first time that Apollo dips its toes in the airport operations of Adani it is their second major deal as their partnership has been in place since 2022 when Apollo Incidentally the American investment giant realized the potential in the aviation boom in India.

The interesting part about this deal is the timing. Timing it to an era when markets across the world are still wary of investing in the emerging economies, the reaffirmation of commitment by Apollo speaks volumes about the very health of the aviation infrastructure in Mumbai. The funding is mostly going to be used as refinancing of old debt and will also be used to create the operational opportunity that Mumbai International Airport requires so as to turn itself into the world-class aviation hub.

This venture, at least according to Adani, means a lot more than money, it is a form of legitimacy by one of the most advanced investment firms in the world. The fact that Apollo has a good track record in infrastructure investments and that they have patient capital best suits how Adani has a long term vision in transforming the Indian airport experience.

Mumbai: Throne Jewel of India Aviation

Inside view of the Mumbai International Airport with modern terminal buildings, waiting areas or passenger departure lobby with passengers demonstrating the cured facilities and passengers.

Such financing is important, in order to comprehend the meaning and the importance of Mumbai International Airport as a part of the bigger picture of Indian aviation. Chhatrapati Shivaji Maharaj of India airport is not simply an airport, it is an entrance to the financial capital of India and the centre of a million people traffic every year and necessary point of international and national traveling.

It has been a very dramatic change of the airport in the hands of Adani. Since it started running operations, the group has invested much in modernization, capacity expansion, and passenger experience. This is not just transferring individuals between points A and B, it is rather providing an airport experience that will be worthy of the world city status that Mumbai is trying to achieve in the commercial sphere.

The statistics are quite amazing. Mumbai airport is always one of the busiest in India and the aviation market of the country is predicted to be the third-largest in the world by 2030, so the strategic value of this financing can hardly be exaggerated. Each rupee that is invested today in the airport infrastructure in Mumbai does not only benefit, but it is a slurry of all the businesses, all the people who travel, and all the communities around that relies upon the efficient aviation connectivity.

The Greater Adani Aviation Empire

Infographic or map of the Adani airport network in India thereby emphasizing the Mumbai International Airport and the project in Navi Mumbai International Airport.

The Mumbai funding is making the headlines, but it is only one point in an enormous saga of Adani becoming the aviation giant of India. It currently has several airports under its operation in the country making it a network effect which adds value to each single property. This is not merely a matter of airport ownership; it is becoming the advanced ground-up, Avtur, aviation ecosystem that can compete with the world leaders.

The jewel in the deal of this expansion is the soon to principally open up Navi Mumbai International Airport the place the Adani aggregate announced near about $1 billion investment, and is intended to kick start activities by December this year. With a capacity to support an incredibly large amount of new demand, this massive greenfield project is the future of aviation in India such that, it is a greenfield airport that has been built to cater to the next generation of air travel demand.

Construction progress photos and architectural rendering of the Navi Mumbai international airport with modern design and scale of the development that is being carried out.

AVP: Adani group Chairman Gautam Adani also made it clear that the Navi Mumbai international airport will be opened in June 2025, which will also create a second major aviation hub of Mumbai. This two-airport solution will place Mumbai in a position to support the exponential increase to serve the Mumbai air traffic and alleviate the congestion at the other single facility.

It is mind-blowing investment amount-wise. In the overall investment of Rs 86.25 billion in the Navi Mumbai airport, Adani invested Rs 17.10 billion in form of equity which reflects the commitment of the group in terms of skin-in-the-game to this game-changing project.

International Trust in Indian Aviation

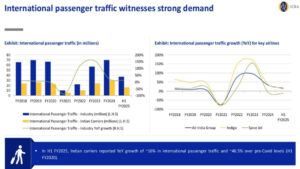

Graph or chart of the aviation general growth pattern in India, the passenger traffic data and the projected outer 10 years aviation growth pattern, in being able to show the trend opportunity of the market that international investors are interested in.]

The eagerness shown by international investors such as Apollo to deploy large amounts of capital in the Indian airport infrastructure indicates itself in an overall attitude of increased assurance about the future of the Indian aviation industry. This is about more than its current demand; this is about preparing to meet future growth which is practically inevitable because of both demographic trends and economic development.

The Indian aviation industry is on a turning point. The fundamentals could hardly be better amid higher middle-income classes, rising urbanization and government policies that are pro-air travel. Foreign investors understand that this growth story is only getting started, especially when dealing with established operators such as Adani, and it is an attractive long-run investment.

The structuring of such financing also is testimony to the coming of age of Indian infrastructure finance. Those were the times when Indian infrastructure projects could hardly attract international capitals. The Apollo-Mumbai Airport transaction is the first step in realizing this, and in showing that Indian infrastructure may indeed compete globally, in raising capital, with the same institutional pool of investors which raises capital to fund state of the art infrastructure projects anywhere.

Strategic vision and Operational Excellence

Collage of different elements of improved airport experience: newer check in counters, redesigned restaurants, shops and other passenger facilities that replicate the transformation on the project managed by Adani.]

The scale of investment is not the only thing that makes Adani method so special; it is the philosophy of operations noting every aspect of it. The group knows that the contemporary airports are much more than travel terminals, they are shopping venues, business forums and social meeting points. Such a comprehensive vision influences such aspects as terminal design, passenger services, or even commercial relationships.

This is evident in the change that was made in the Mumbai airport. Travelers now enjoy much more options in the dining facilities, better shopping experience and ease of security procedures, and of contemporary international concerns. Such developments do not occur haphazardly, but they need long-term investment and vision of how the airport experience ought to be.

Over the scenes, Adani has invested vastly into its technology infrastructure, staff training and operational system. It is not merely about transporting more passengers; it is about making the journey of going air travel by Mumbai, something that the passengers will look forward to attending instead of making it a must to go to such a toll.

Financial Engineering and strategic Flexibility

The new Apollo funding is the example of smart financial engineering that offers greater financial versatility to Adani along with the optimal cost of capital. Refinancing of current debt with an investment-grade financing eliminates front-loading of the finance cash flows of the company in that it lowers the cost of borrowing all the time extending maturity profiles-giving a breathing space to the long term strategic efforts.

This kind of financial optimisation plays a very essential role in the capital-intensive business of airports. The airport business is distinct in that cash justice is very slow, unlike many other businesses where returns can be received within a very short period, this particular industry not only requires patient capital but can take quite a number of years to achieve full returns of the investments made in the general infrastructure to the terminals, runways, and support functions.

It has a high investment-grade rating especially of this financing. It does not only depict the credit quality of Adani, but the resilience behind Mumbai airport as a cash generator. It is not an investment-grade designation that ratings agencies give away without evidence of cash flows or market positions as well as management teams that could be believed.

The True Challenges and Opportunities

There are always some hurdles when it comes to such an immense change and the same thing happens in the case of the aviation expansion of Adani. The recent cases of conflicts with large airlines on payment conditions show fine line that is necessary to observe by airport operators between their needs of operation services, and customer relations. Mumbai airport caused a lobby group to be created by the leading airlines IndiGo and Air India because it altered paying patterns and claimed that it had to do so due to financial demands and the threat of airline default.

These operational risks are serious, though they are normal to infrastructure businesses that have had high growth rates. The trick is in approaching them, without losing steam in the pursuit of bigger strategic goals. Record shows that Adani has the work experience and the capital to deal with this and manage within these challenges.

The prospects are huge in future. The low-cost carriers of India will spearhead the migration to the Navi Mumbai Airport with its opening scheduled in May and the new development will offer opportunities to fuel new growth and opportunity to de-chapter much-used facilities. This decentralization of aviation capacity in Mumbai ought to ease numerous operational burden at present and generate new sources of income.

Technology Factor

Contemporary airport technology at work – intelligent baggage systems, biometrics to get into the plane, digital boarding pass, or the interface of mobile applications to see how much we have invested in technology infrastructure.

Sophisticated technology infrastructure is also becoming the norm in the operations of modern airports, and this fact is exemplified in the investments of Adani. The various aspects of the technology-based infrastructure in an airport, starting with the automated baggage handling systems, continuing with the biometric security procedures, and extending all the way to the system of real-time portrayal of necessary information to the passengers themselves, must be invested in and constantly updated.

The funding mechanisms do not only give access to physical infrastructure, but also to the digitalization that contemporary customers demand. Modern passengers are willing to see convenient connection, mobile check-ins, current flight status, and a ground transportation booking integrated. In meeting these expectations, there should be significant investments in technology, which supplements facility enhancements.

Data driven airport operations Artificial intelligence and machine learning are becoming more critical with airport operations, including: optimising gate allocations, forecasting maintenance requirements and managing passenger flows at peak times. Such technologies involve initial investments, but provide long term operations savings which are beneficial to the operators and passengers.

Future-proofing and Environmental sustainability

[Green airport movements The usage of solar panels on airport buildings, energy efficient designs of the terminals, or even eco friendly modes of transport, revealing the fact that we also have to take care of the environment in developing airports in the modern days.]

The contemporary airport construction cannot disregard the consideration of environment, and the practices of Adani are indicative of the increased sensitivity towards the demands of sustainability. New buildings use energy efficiency designs, waste minimization systems and renewable energy, where possible. These are not a mere feel-good program, but they are becoming much more necessary for regulatory compliance and operational cost control.

The special case of Navi Mumbai project is an opportunity to incorporate sustainability in the building blocks instead of makeshifts. Whether it is the terminal design aimed to maximize the impact of natural lighting to the integration of ground transportation to minimize the emission, every detail of the new facility can be designed using the best practice in sustainable infrastructure development.

Long term sources of finance such as the Apollo are considering more and more the environmental impact when making investments. Plants that prepare and respond to the dynamics of sustainability are likely to be able to preserve their competitive statuses and regulatory standards over multi-decade lifespan of major infrastructure investments.

Regional economic effect

Images of airports and the airport directly in contact with the rest of the metropolitan area or photographs of local enterprises, hotels, and economic activity that can improve with the help of better aviation infrastructure.

The revolution around the aviation infrastructure in Mumbai does not only end with the airports. Improved connectivity promotes economic growth, tourism growth and business growth all over the region. Better aviation infrastructure is the gain of hotels, restaurants, logistic companies and many more firms.

The effect on employment is especially high. Direct airport jobs include thousands of posts at varying competency levels, including entry-level job areas such as service and highly technical work areas such as maintenance and operations. These impacts are multiplied as a result of indirect employment effects through the regional economy.

In the case of Mumbai in particular, it is necessary to have world-class aviation infrastructure in its quest to become the financial capital of India. In a rapidly globalizing world economy, cities face some competition based on the quality of their international connectivity. This kind of investment that Adani is making is making sure that Mumbai can keep up with the other large Asian trading cities.

Going Forward The Next Chapter

Since this new funding is being closed, and the Navi Mumbai Airport is to open soon, a new book in the structure of Mumbai aviation life is being opened. Foreseen growth in the future would have no chance against the addition of newer and improved facilities to old infrastructures and the greenfield capacity built to meet the future needs of the city.

The joint venture with Apollo and other foreign investors not only offers finances, but a stamp of esteem, which further opens the gate to other finance prospects in future. With Adani still going strong in terms of the aviation footprint, Mumbai’s success record becomes its business calling card to other markets and opportunities.

Above all, the success of such initiatives indicates that Indian infrastructure is globally competitive in terms of raising capital as well as in operational brilliance. The implication of this are far more deep-seated and more than just aviation because what has been demonstrated is that, given the right approach, the development of Indian infrastructure can tap into global best practice and funding to fast track development.

Conclusion: Creating the Future of AVIATION of India

What happened at Adani Mumbai airport funding is that the issue behind financial transactions is far bigger as it is concerned with the infrastructural development platform of India as countries continuously grow economically. The payback on such strategic investments is in terms of every passenger that enjoys better facilities, every business that benefits through better connectivity and every community that enjoys resulting enhancement in their economic lives.

World-class infrastructure shall be a requirement as India progresses on its way to transforming itself into a developed economy. This is especially true of the aviation sector, which has multiplier effects in the whole economy. The case of developing the Mumbai airport offers a model to follow in the future of how to come up with an infrastructure that other industries and regions could model.

Such examples as cooperation between Adani and foreign offers such as Apollo shows that there are no obstacles to international best practices and global capital markets to developing Indian infrastructure. This is not merely a project of airport construction it is the development of the basis through which India is destined to grow once again.

The development of air transport facilities in Mumbai is an opportunity, growth, and development to the travelers, investors, and the Indian economy at large. When these investments bear fruit in the months and years ahead they will go down as a permanent record of how strategic vision, patient capital and operational excellence can be used to create world-class infrastructure.

The future of Indian aviation is being written today and the Mumbai International Airport will be at the center of the same. Adani has a solid financial support, a clear vision, and operating skills that enable it to fulfill the mandate of providing the world class aviation infrastructure to the passengers and the economy as well as presenting the infrastructure ability of India to the world.

The last image – The picture of a futuristic picture of the aviation landscape in Mumbai, which could feature known and upcoming airports, aircrafts and their crazy hustle and bustle that the future of the Indian aviation landscape promises to be.